Have you ever met a business owner who didn’t want to save money? Yet, the way some companies try to cut costs can have the opposite effect. With the economy leaving little room for error, trimming unnecessary expenses is the logical first step toward keeping more profit. Unfortunately, risk management is sometimes looked upon as one of those unnecessary expenses.

It could be that some businesses don’t fully recognize the benefits a risk management culture can have. Instead, owners may be discouraged by the amount of time and money needed to reach that point. Successful businesses, on the other hand, know that to avoid possible financial pitfalls, they need to reduce their exposure. They realize risk management, despite the time and financial investment it can require, can have overall economic benefits while creating a safer working environment.

Involvement is key

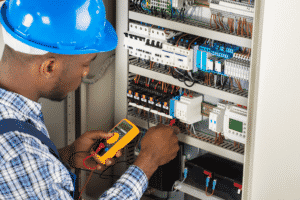

No company, no business owner is immune to the possibility of losses. Indeed, the act of running a business exposes owners to everyday risks, such as fire, vehicle accidents, or even fraud. Identifying risks ahead of time and then dedicating resources and effort to avoid them through aggressive risk management can help keep a business ahead of the game.

Why bother?

It may feel counterintuitive to believe that a risk management culture—the sum total of all the efforts, attitudes, and investments related to workplace safety and loss prevention—can actually improve your bottom line. But, investing in risk management can definitely have advantages:

- First, by managing risk, your company could experience fewer insurance claims. That may equate to lower insurance premium.

- Second, fewer claims means you also help reduce the “after effects.” Insurance is meant to cover the direct costs associated with a claim, such as property damage, medical bills, and legal expenses. What is often not anticipated, however, are the unexpected, “hidden” costs from a loss. For example, insurance may not cover the cost of hiring and training a replacement employee, lost productivity, negative publicity, higher premiums related to the loss…and the list goes on. These are typically out-of-pocket expenses and can quickly add up. It could take a lot of extra sales to recoup those losses.

- Last, workers compensation claims often result in a higher work comp mod. Not only can this have an immediate effect on your premiums, the consequences could be felt for a long time.

Business owners who take risk management seriously understand its positive effect on their operations, both from employee well-being and financial standpoints. They see immediate value in being proactive. As one company risk manager put it, “There are many business owners who believe that risk management is too expensive. I would challenge them to put a pencil to it. I think they will be surprised that safety pays.”

Attending a Federated Insurance Risk Management AcademySM seminar can be an effective way to start or grow your risk management program. Upcoming 1- and 2½ -day sessions are posted at federatedinsurance.com, or contact your local Federated representative for more information.